Melrose Votes: All About Proposition 2½

On June 18th, Melrose residents will vote on a measure to pass a $7.7 million Proposition 2½ property tax override. If a majority of voters support the measure, the city will be able to fund much of the superintendent's proposed school budget and also avoid making cuts to other city departments and services.

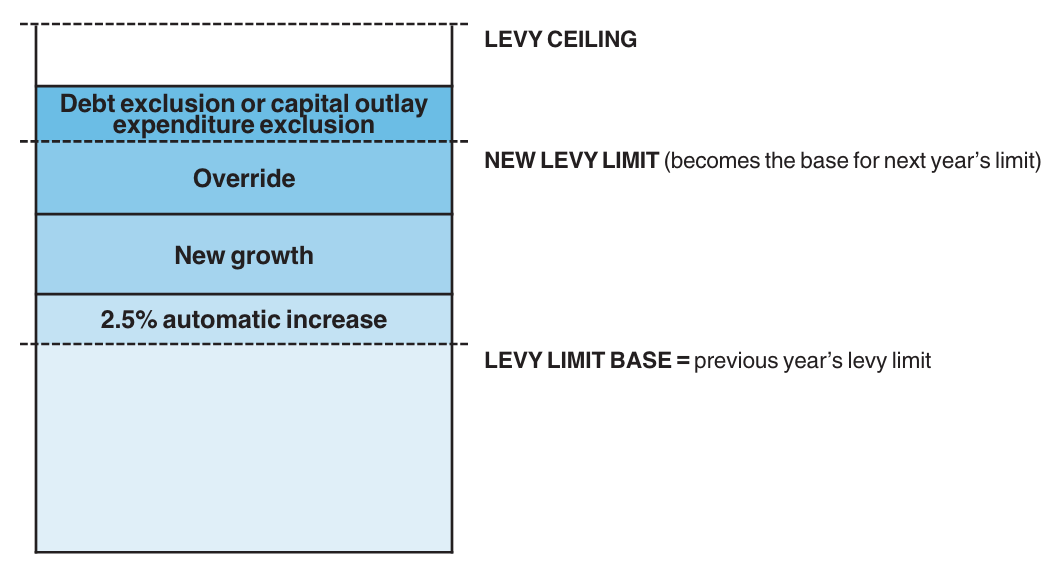

Figure A: How levy limits increase from year to year

Proposition 2½ was a statewide ballot initiative that passed in 1980. It prohibits towns and cities in Massachusetts from raising property taxes by more than a certain amount each year. Specifically, towns can raise their total tax levy (the total amount of property taxes collected from all residences and businesses in the town each year) each year by no more than 2.5% plus some amount calculated to reflect new growth in the town.

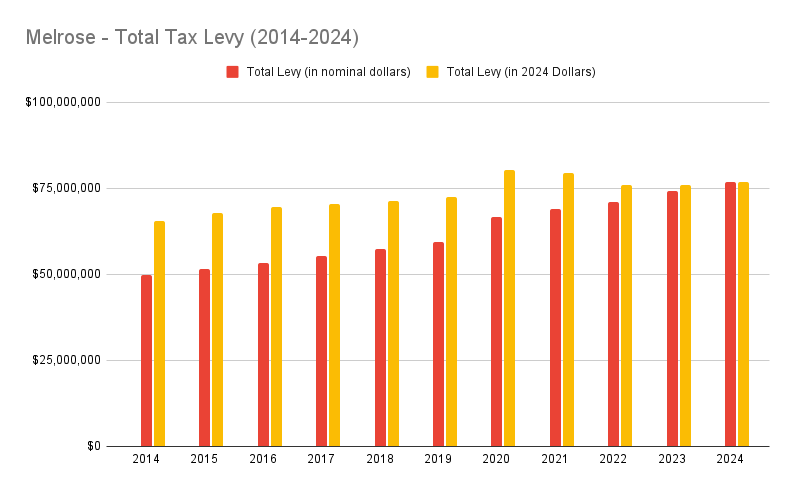

Figure B: Melrose's Total Tax Levy, 2014-2024

Data from DOR, inflation rate calculated using the Consumer Price Index

Figure A shows how this works: each year’s levy limit (the maximum amount the city can raise in property taxes each year) is used as the basis for the next year’s levy limit. The 2.5% automatic increase and the amount calculated for new growth are used to determine the next year’s levy limit. Based on this limit, the town assesses residential and commercial property taxes based on the assessed value of each home or business.

For a city or town to increase its tax levy in a year by more than 2.5% plus new growth, voters must approve a Proposition 2½ override, allowing the town to raise the total tax levy by a specific amount, which then allows city officials to use that increased number to calculate the following year’s tax levy. This is why a Proposition 2½ override is sometimes called a “permanent tax increase” - because that increase is then used to determine the levy limit for following years.

In 2019, Melrose voters approved an override in the amount of $5.18 million. While the 2019 override amount did increase the money available for the city budget, inflation has outpaced the amount the tax levy could increase by for 3 of the last 4 years, meaning that, in real dollars, the city’s total tax levy has actually decreased since 2020 (as shown in Figure B).

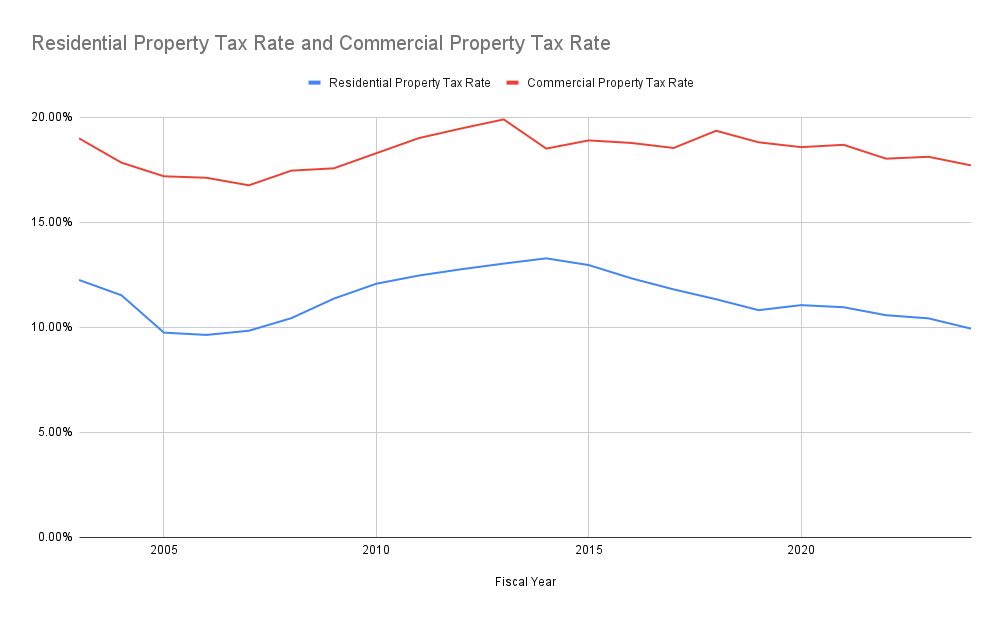

Figure C: Melrose Property Tax Rates (Residential and Commercial), 2003-2024

Proposition 2½ also allows cities and towns to pass debt exclusions, which apply only to debt taken on for a specific purpose. As shown in Figure A, a debt exclusion allows the city to levy taxes above the levy limit for the life of this debt, although these additional taxes can only be used to pay off the bonds specified in the debt exclusion vote.

Melrose currently has two active debt exclusions: bonds for the construction of the middle school will be maturing in 2029, and in 2023, Melrose voters approved a debt exclusion for $130 million for construction and renovation of public safety buildings. These bonds will be issued at several points over a three-phase construction process between now and 2030.

As Figure C shows, although most people’s property tax bills have risen along with increasing home values in Melrose, the residential property tax rate has actually decreased since it reached a high of 13.3% in 2014. The 2020 override caused the residential property tax rate to increase by .25%, but it has continued to decline since then. Currently, Melrose has one of the lowest residential property tax rates in the region - lower than our neighbors in Stoneham, Wakefield, Saugus, and Malden.

Read Sandy Dixon's substack article comparing our taxes and school budget to Wakefield's here.

How would the override affect your property taxes?

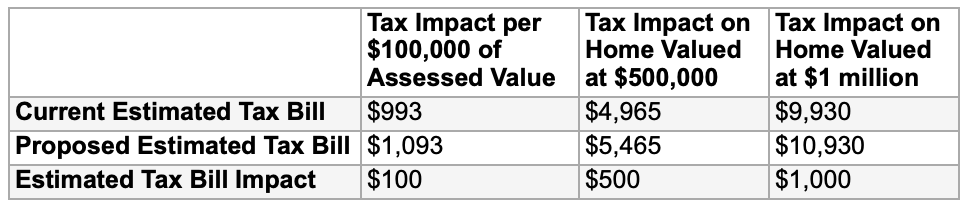

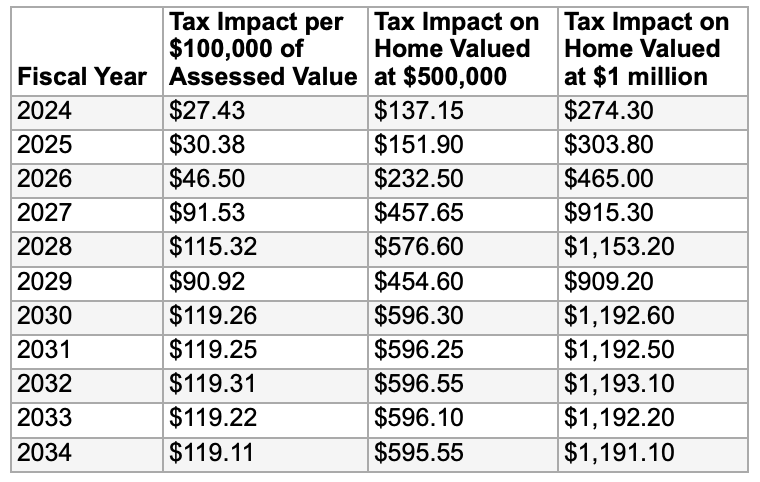

In the two charts below, you can see how a $7.7 million override would affect your property taxes, and how it would interact with the $130 million debt exclusion for the public safety buildings that passed last November.

Figure D shows how the override would affect your property taxes for next year: find the assessed value of your home to see the override's impact. Figure E shows the city's projections for how the debt exclusion will affect taxes over the next 10 years; the numbers for 2024 are already included in the amounts given in the first chart.

Figure D: How a $7.7 million override would affect property taxes in Melrose

Figure E: How debt exclusions are projected to affect property taxes in Melrose, 2024-2034

Follow Us: